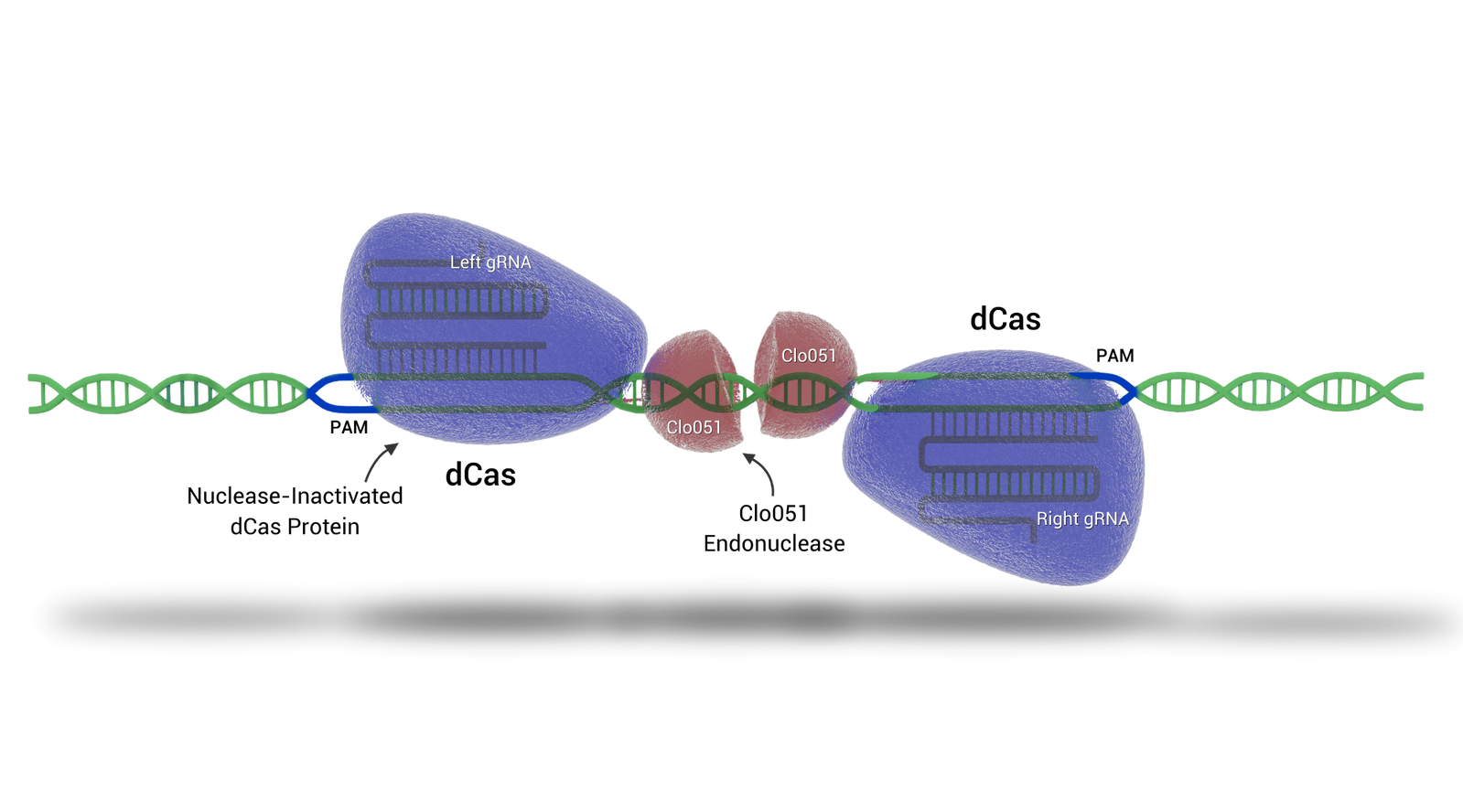

Cas-CLOVER

Cas-CLOVER 'the clean alternative to CRISPR/Cas9' introduces targeted double-strand breaks in genomic DNA, enabling knockouts and site directed knock-ins with high precision.

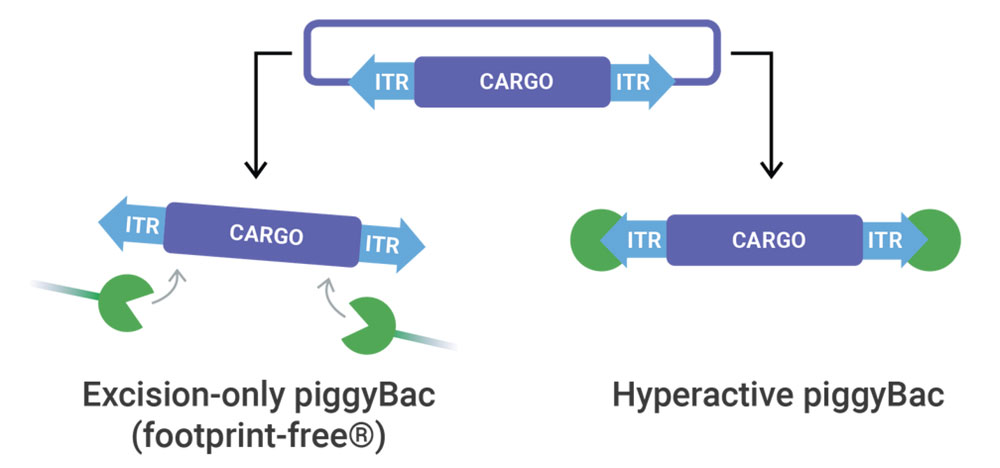

piggyBac Transposase

At elevated efficiencies, piggyBac transposase delivers any sized genetic cargo for stable and high expression. When Footprint-Free gene editing is required, excision-only piggyBac seamlessly removes genetic cargo.

Validated In Mammalian Cells, Yeast, and Plants

We optimize gene editing platforms for broad commercial applications and organisms.

Pharmaceutical Bioprocessing

Bioprocessing and cell line engineering for therapeutic biomanufacturing

Synthetic Biotechnology

Microbial strain engineering to produce therapeutics, industrial enzymes, compounds or biofuels

Agriculture Biotechnology

Targeted editing in plants for transgene-free trait discovery and development

Trusted By Leading Biotechnology Organizations

As Seen In Top Tier Publications

Our gene editing technology has been featured in leading publications.

We provide commercial gene editing licenses and exceptional know-how transfer

Contact us to learn more about our independent gene editing technology IP, optimized reagents and internal expertise to help guide smooth adoption.